Pension increases

The majority of deferred members, pensioners and dependants will receive an annual increase to their pension, however there are some exceptions. For those members who do receive an increase, their pension will be increased each year on 1st April.

Whether your pension will increase each year and how much increase is paid will depend upon your category of Fund membership and the component parts of your pension. Your pension can be made up of either a combination of both elements, or one element on its own.

Guaranteed Minimum Pension (GMP)

If you (or if you are a dependant pensioner, your spouse) were an employee member between 6th April 1978 and 5th April 1997, part of your pension may include a GMP element. Your GMP will be roughly equal to the additional State pension you would have built up had you not joined the Fund.

If you joined the Fund after 5th April 1997 you may also have a GMP element if you transferred-in a pension from another scheme, which included a GMP benefit.

Any GMP element of your pension will be increased in line with statutory increases published by the government, explained below.

Your "excess" pension

Any remaining balance of your pension above the GMP amount is known as the “excess” pension. Any excess pension will receive increases in accordance with the Rules of the Fund, as explained below.

Increases are applied on 1st April each year and you will receive a letter towards the end of April each year informing you of the increase and the current amount of your deferred pension or pension in payment. The letter details the amounts of any GMP and excess elements of your pension and the current amount of any spouse's pension payable on your death.

Increases to deferred pensions and pensions in payment

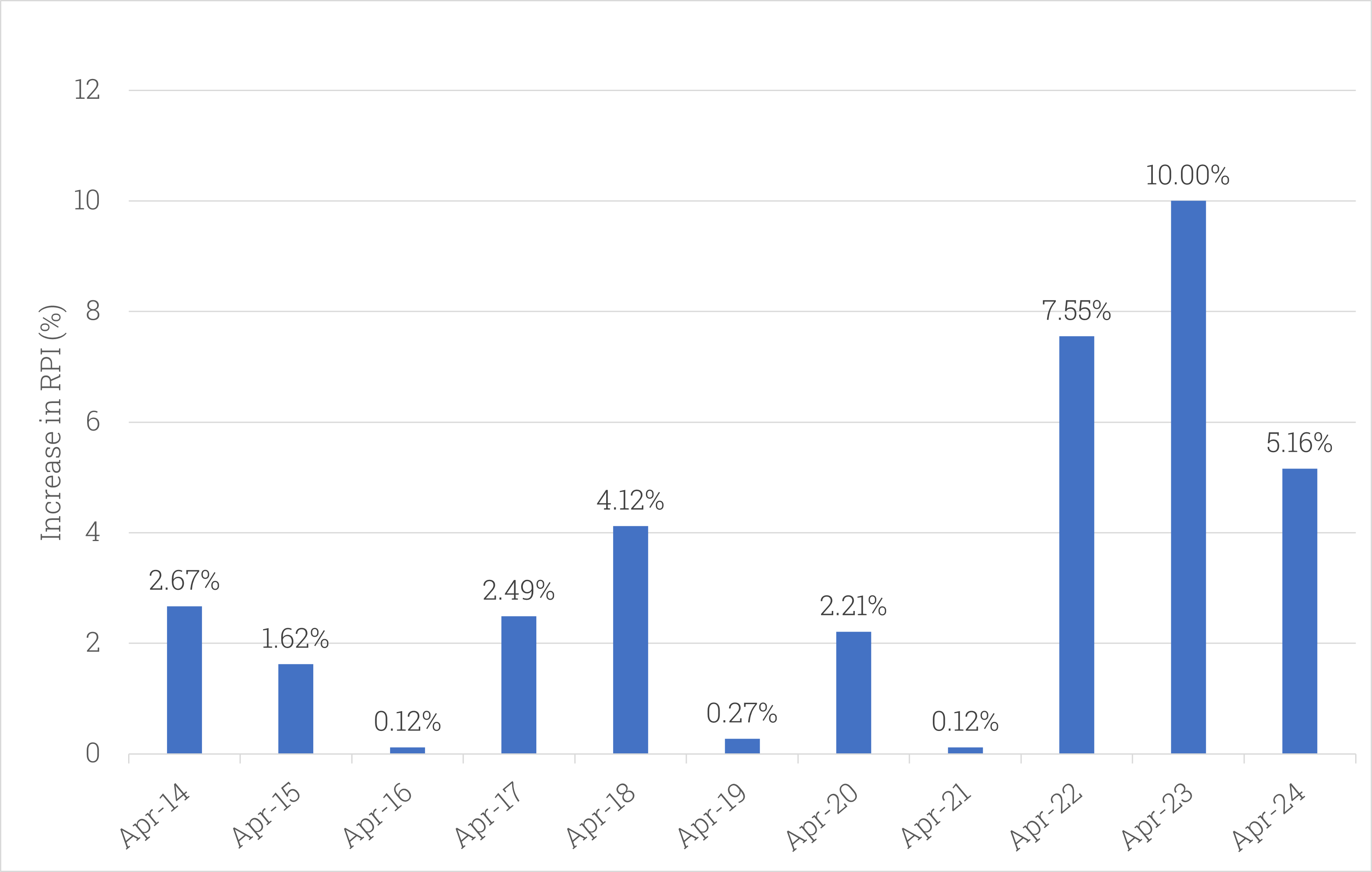

Your pension (excluding any GMP) will be increased each year on 1st April by the rise in the Retail Price Index over the 12 months to the preceding December subject to a maximum increase of 10% per annum.

From age 80, increases to pensions in payment will be subject to a maximum increase of 15% per annum.

Increases to deferred pensions and pensions in payment

Your pension (excluding any GMP) will be increased each year on 1st April by the rise in the Retail Price Index over the 12 months to the preceding December subject to a maximum increase of 5% per annum.

Please contact the Pension Fund Office for details.

This is the minimum pension the Fund must provide you with once you reach GMP payment age, which is 60 for women and 65 for men.

The Fund was contracted-out of the old additional earnings component of the State Pension Scheme, which used to be known as the State Earnings-Related Pension Scheme (SERPS) and later became known as the State Second Pension (S2P). This part of the old State Pension Scheme was payable in addition to the Basic State Pension.

If you were an employee member of the Fund between 6th April 1978 and 5th April 1997 you would have been contracted-out of SERPS and as a result the Fund must provide you with a GMP. Your GMP will be roughly equal to the Additional State Pension you would have built up had you not joined the Fund.

If you joined the Fund after 5th April 1997 you may also have a GMP if you transferred-in a pension from another scheme which included a GMP benefit.

The GMP element of your deferred pension will increase or “revalue” at a different rate from the rest of your Fund pension up to GMP payment age (60 for women, 65 for men). The applicable rate will depend upon the date you left pensionable service as follows:

Date of termination of C/O employment Fixed Rate of Revaluation

6 April 2022 - 5 April 2027 3.25%

6 April 2017 - 5 April 2022 3.5%

6 April 2012 - 5 April 2017 4.75%

6 April 2007 - 5 April 2012 4.0%

6 April 2002 - 5 April 2007 4.5%

6 April 1997 - 5 April 2002 6.25%

6 April 1993 - 5 April 1997 7.0%

6 April 1988 - 5 April 1993 7.5%

Before 6 April 1988 8.5%

Your GMP will be increased (or revalued) at one of the above rates depending on the date you left pensionable service for each complete tax year between your date of leaving and GMP payment age. The rate applicable for you would have been shown on your certificate of deferred pension benefits, which would have been sent to you on leaving pensionable service.

Any GMP element of your pension will receive different increases in line with statutory orders once you reach GMP payment age, which is 60 for women and 65 for men.

Any GMP earned between 6th April 1988 and 5th April 1997 will be increased in line with the Consumer Prices Index subject to a maximum increase of 3% pa.

Under legislation the Fund is not required to pay increases on any GMP earned before 6th April 1988.

If your pension in payment consists entirely of GMP that was earned prior to 6th April 1988 it will not receive an annual increase. This is because under legislation the Fund is not required to increase this element of your GMP once you reach GMP payment age (60 for women and 65 for men).